Before booking Botox, fillers, or CoolSculpting, it is essential to compare clinic prices and financing terms carefully. This article explains how clinics set aesthetic procedure prices, typical U.S. price ranges, and how CareCredit financing works, including common interest-rate structures and deferred-interest traps. Learn practical steps to compare quotes, avoid overpaying, and choose safer payment options that protect your budget and your results.

How CareCredit Works and Understanding Interest Rates

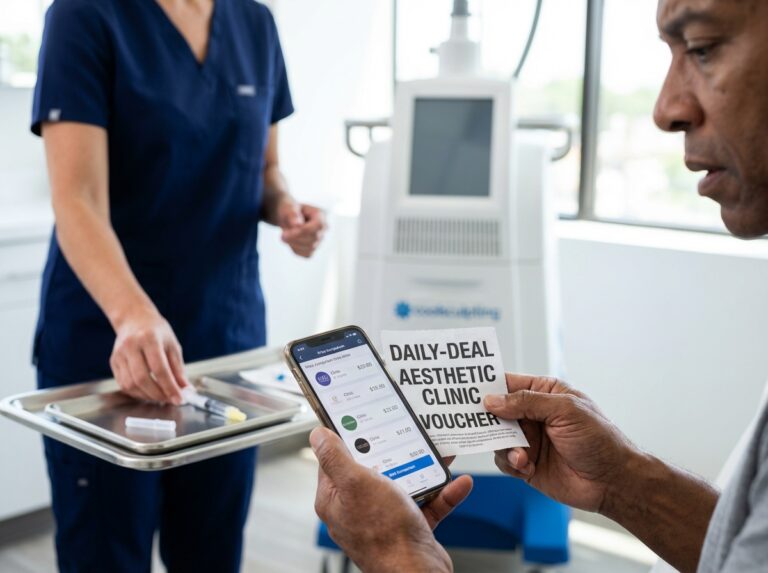

CareCredit functions as a specialized credit card designed specifically for healthcare and wellness expenses that insurance typically does not cover. Issued by Synchrony Bank, it differs from a traditional credit card you might use for groceries or clothes. It is intended for out-of-pocket medical costs, including elective aesthetic procedures like Botox, dermal fillers, and body contouring. You can apply for the card online or at a participating clinic. The approval process is usually fast; many patients apply directly from their phone while sitting in the waiting room and receive a decision within minutes. If approved, you can often use the credit line immediately, even before your physical card arrives in the mail.

When you apply, the system often uses a soft credit inquiry to check if you prequalify, which does not impact your credit score. However, if you decide to accept the offer and complete the full application, the bank performs a hard credit inquiry. This hard pull may cause a small, temporary drop in your credit score. Once approved, you receive a credit limit restricted to a specific network of providers, which you can locate using the CareCredit provider search tools.

The Reality of Interest Rates

While the card has no annual fee, the interest rates are significantly higher than those of many standard credit cards. As of the most recent disclosures from May 2024, the purchase APR for new accounts is 32.99 percent. This rate applies to any purchase that does not qualify for a promotional plan or if you fail to meet the terms of a promotion. Additionally, there is a penalty APR of 39.99 percent that may be triggered by late payments. These numbers mean that carrying a balance without a promotion is very expensive. You must verify the current APR in your specific account agreement, as rates can vary based on the economy and your credit history.

Understanding Promotional Financing Options

Most patients use CareCredit because of the promotional offers, but it is vital to distinguish between the two main types. The first is the “No Interest If Paid in Full” plan, available for periods of 6, 12, 18, or 24 months on purchases of 200 dollars or more. The second type is the “Reduced APR” plan, designed for larger purchases. For example, a purchase of 1,000 dollars or more might qualify for a 24, 36, or 48-month plan with a lower interest rate, while a purchase of 2,500 dollars or more might qualify for a 60-month plan. These reduced rates typically range from 17.90 percent to 20.90 percent. While lower than the standard 32.99 percent, these plans are not interest-free; you will pay interest every month from the date of purchase.

The Deferred Interest Trap

The “No Interest If Paid in Full” option is where many consumers face unexpected costs. This is a deferred interest plan, not a zero percent APR card. With deferred interest, the bank calculates interest at the standard 32.99 percent rate starting from the day you buy the treatment. This interest is not charged to your account as long as you pay the entire balance before the promotional period ends. However, if you leave even one dollar on the balance after the deadline, the bank adds all that back-calculated interest to your bill at once. This can result in a massive, sudden charge. Missing a single monthly payment or being late can also trigger this retroactive interest.

Sample Math for a 2,000 Dollar Treatment

To understand the risk, consider how the numbers change for a 2,000 dollar filler and Botox package. The table below compares a successful payoff with a missed deadline using the standard 32.99 percent APR.

| Scenario | Monthly Payment | Total Interest Paid | Total Cost |

|---|---|---|---|

| Paid in full within 12 months | $166.67 | $0.00 | $2,000.00 |

| Missed deadline (Paid in 13 months) | $166.67 | $659.80+ | $2,659.80+ |

In the second scenario, the interest charged is not just for the thirteenth month; it is the accumulated interest for the entire year. This is why tracking your payoff date is vital. You should aim to pay off the balance at least one month before the promotion actually expires to avoid this financial pitfall.

Impact on Credit Utilization

Beyond the hard inquiry, using CareCredit affects your credit utilization ratio. If you are approved for a 3,000 dollar limit and immediately spend 2,500 dollars on CoolSculpting, your utilization on that card is over 80 percent. High utilization can lower your credit score even if you make all your payments on time. This is a major difference compared to a personal loan, which is an installment product and does not affect your revolving credit utilization in the same way.

Questions to Ask Before You Sign

Before committing to financing, you must get clear answers from both the clinic and the lender. Not every clinic offers every promotional plan; some might only offer the 6-month version because the clinic must pay a fee to the bank to offer longer terms. Ask the following questions:

- What is the exact name of the promotional plan being applied to my purchase?

- Is this a deferred interest plan or a reduced APR plan?

- What is the exact date the promotional period ends?

- What is the required minimum monthly payment, and will it be enough to pay off the balance by the end of the promo?

- Are there any origination fees or service fees added by the clinic for using financing?

- What happens to the interest if I am one day late on the final payment?

You can find more details on the CareCredit FAQs page regarding how interest is calculated. It is also helpful to use the Estimated Monthly Payment Calculator to model your specific treatment cost. Always remember that clinic staff are not financial advisors; you are responsible for reading the fine print in your Synchrony Bank agreement.

How Clinics Price Services and Ways to Avoid Overpaying

Clinics in the United States operate on a retail model for aesthetic treatments. They purchase products like Botox or Juvéderm from manufacturers and apply a markup that covers their overhead costs. For a typical Botox treatment, the average cost is around 420 dollars. This price often reflects a per-unit charge. Some clinics charge per area, which can sometimes be more expensive if you only need a small amount of product. Dermal fillers are usually priced per syringe. You can expect to pay between 707 and 843 dollars for a single syringe of a hyaluronic acid filler. These prices vary based on the specific brand used. Brands like Juvéderm or Restylane have different formulations for different parts of the face; a thicker filler for cheek volume will often cost more than a thinner one for fine lines around the mouth.

Understanding Clinic Pricing Logic

The price you see on a menu is not just the cost of the liquid in the syringe. It includes the injector’s time, the facility’s rent, medical malpractice insurance, and the cost of specialized equipment. When a clinic prices Botox at fifteen dollars per unit, they might be paying five or six dollars per unit to the manufacturer. The remaining nine or ten dollars covers everything else. Fillers have a similar structure. A syringe that costs the clinic three hundred dollars might be sold to you for eight hundred dollars. This markup is standard in the industry. It is important to understand that you are paying for the skill of the person holding the needle. A cheaper price often means the injector has less experience or the clinic is cutting corners on safety protocols.

Brand choices matter for both price and outcomes. Neuromodulators like Botox, Dysport, and Xeomin all work similarly but have different price points and onset times. Some patients find that one brand lasts longer for them than others. Hyaluronic acid fillers also vary. Some are designed to be highly flexible for areas with a lot of movement, such as the lips, while others are more rigid for structural support in the chin or jawline. Choosing a brand based solely on the lowest price can lead to a result that does not look natural or does not last as long as expected.

Tactics to Avoid Overpaying

Bundling is a strategy clinics use to increase the total sale. They might offer a package that includes three sessions of CoolSculpting or a combination of filler and neuromodulators. These packages are designed to look like a bargain, but you should evaluate if you actually need every service in the bundle. If you only need one syringe of filler, buying a package of three is not a saving; it is an unnecessary expense. Always ask for the individual price of each service before agreeing to a package.

Negotiation is possible even in high-end medical spas. Many clinics prefer cash or debit payments because they do not have to pay credit card processing fees. You should ask if there is a cash discount, which can sometimes shave five percent off your total. Another tactic is to ask for price matching. If a reputable clinic nearby offers the same treatment for less, your preferred provider might match it to keep your business. Always request an itemized invoice showing the cost of the product, the injector fee, and any facility fees. It helps you see exactly where your money is going and prevents hidden fees from being added to a lump sum.

Evaluating Provider Value

Price inflation is often driven by marketing. A clinic with a massive social media presence and a prime location will charge more to cover those costs. This does not always mean the results are better. You should prioritize provider experience over the aesthetic of the waiting room. Look at their before and after portfolios to ensure their style matches your goals. Read independent reviews on third-party sites rather than just the testimonials on the clinic’s own website. Verify that the person performing the injection is a licensed professional with specific training in aesthetics. A higher price is only justified if the provider has a proven track record of safety and aesthetic excellence.

Actionable Decision Flow

To avoid costly mistakes, follow a structured decision flow before booking. First, obtain three itemized quotes from different reputable providers to get a baseline for the local market. Second, verify the credentials of each injector and look for specialized certifications. Third, ask about financing options and the associated interest rates. If you are considering a credit line, check the CareCredit FAQs to understand the terms. Fourth, decide if the cost fits your monthly budget without relying on high-interest debt.

Financing can be a useful tool if used correctly. If you qualify for a no-interest promotion for 12 months on a 2,000 dollar treatment, your monthly payment would be about 167 dollars. This allows you to get the treatment now and pay it off over time. However, if you miss the deadline, the interest is backdated to the purchase date at a rate of 32.99 percent. This is a significant financial risk. If you cannot guarantee that you will pay the balance in full, it is better to delay the treatment. Saving up for a few months is a safer choice than risking a high-interest debt trap.

Frequently Asked Questions

Navigating the financial side of aesthetic treatments requires as much attention as choosing the right provider. This section provides direct answers to the most frequent questions regarding CareCredit and price comparisons. You should always verify current legal or financial details with the lender or your specific clinic before signing any agreement.

Can I use CareCredit for Botox, fillers, CoolSculpting, and other non-surgical procedures?

You can use CareCredit for a wide variety of non-surgical aesthetic treatments. This includes neuromodulators like Botox, dermal fillers such as Juvéderm or Restylane, body contouring procedures like CoolSculpting, and various laser skin resurfacing options. The card is designed for health and wellness expenses that insurance typically does not cover. You must ensure your chosen clinic is part of the CareCredit network, as not every medspa or plastic surgery center accepts this form of payment.

Is CareCredit the same as a credit card?

CareCredit is a credit card, but it functions differently than a standard Visa or Mastercard. It is a revolving line of credit specifically for healthcare services. You can use it repeatedly for different procedures once you are approved. Unlike a general-purpose card, you cannot use it at gas stations or grocery stores; it is only accepted at enrolled healthcare providers and select retail locations. While it offers specific promotional financing options that standard credit cards usually do not provide, it still requires monthly payments and carries a high standard interest rate if you do not use a promotion.

What is deferred interest and how does it work?

Deferred interest is a common feature of the “No Interest If Paid in Full” promotions. Under this arrangement, interest is not charged to your account if you pay the entire balance before the promotional period ends. The trap lies in the fine print: interest builds up in the background starting from the date of purchase. If you have even one dollar left on the balance when the period expires, the lender adds all that backdated interest to your bill. For new accounts as of May 2024, the purchase APR is 32.99 percent. You can read more about these mechanics on the Understanding Promotional Financing page.

Are there fees to open a CareCredit account?

There is no annual fee for the standard CareCredit credit card. You do not pay a fee just to have the account open or to apply for it. However, you will encounter fees for late payments or returned checks. There is also a minimum interest charge of 2 dollars if your account is subject to interest. Some clinics might mention a transaction fee, but CareCredit generally prohibits providers from adding surcharges directly to the patient for using the card. You should always ask the clinic if their quoted price is the same regardless of the payment method.

What happens if I miss a payment during a promotional period?

Missing a payment is a serious mistake during a promotional window. You will likely be charged a late fee, which can be up to 41 dollars depending on your history. More importantly, a late payment can void your promotional terms. If the promotion is cancelled, the high standard APR of 32.99 percent or a penalty APR of 39.99 percent might be applied to your remaining balance immediately. You must make at least the minimum monthly payment on time every single month to keep the promotion active.

Will applying for CareCredit affect my credit score?

Applying for a CareCredit card usually involves a hard credit inquiry, which can cause a small temporary dip in your credit score. Most lenders perform this check to determine your creditworthiness and set your credit limit. Some clinics offer a prequalification step that uses a soft pull which does not affect your score, but the formal application that leads to an account opening will be recorded on your credit report. If you are planning to apply for a mortgage or a car loan soon, you should consider how this new inquiry might impact your overall credit profile.

Do clinics charge extra to accept CareCredit?

Most clinics do not add a visible surcharge for using CareCredit because it may violate their merchant agreement. However, clinics do pay a percentage of the transaction to CareCredit as a processing fee. Because of this, some clinics might not offer their deepest discounts or package deals to patients who use financing. They might have a standard price for financing and a lower price for cash. You should always ask for the “out the door” price for both options to see the difference.

Are cash discounts common and how to ask for them?

Cash discounts are very common in the aesthetic industry. Clinics prefer cash or debit payments because they avoid high merchant processing fees. You can often save 5 to 10 percent by paying in full upfront without financing. To ask for this, be direct: state that you are comparing payment options and want to know if there is a lower price for paying with cash or a check. Many providers are willing to negotiate, especially for high-ticket items like a full series of CoolSculpting or multiple syringes of filler.

How to compare total cost between financing offers?

To find the true cost of a procedure, you must look beyond the monthly payment. Add up every single payment you will make over the life of the loan. If you use a reduced APR plan for 24 months at 17.90 percent, you will pay significantly more than the original price. For example, a 2,000 dollar procedure might end up costing 2,400 dollars after interest. Compare this total to the cash price. If the cash price includes a 10 percent discount, the gap becomes even wider.

Sample scripts for calling clinics

Using a script helps you get clear information without feeling pressured by sales tactics. Here are a few ways to phrase your questions:

- “I am interested in Botox and fillers. What is your total out-of-the-door price for this treatment if I pay in full with cash today?”

- “Do you accept CareCredit, and which specific promotional plans do you offer for purchases over 1,000 dollars?”

- “Is there a price difference between your cash price and the price if I use a 12-month no-interest financing plan?”

- “If I book a package of three CoolSculpting sessions, can I get a discount for paying the full amount upfront?”

Always ask for an itemized quote in writing. This prevents the clinic from adding unexpected facility fees or consultation charges later. Comparing these itemized quotes from three different providers is the best way to ensure you are not overpaying for your aesthetic goals.

Final Takeaways and a Practical Action Plan

Making a final decision on an aesthetic procedure requires balancing your personal goals with a realistic look at your bank account. Prices for common treatments like Botox or dermal fillers vary significantly between clinics. While one office might quote 420 dollars for a Botox session, another could charge much more based on their location or the expertise of the staff. Financing tools like CareCredit offer a way to manage these costs, but they require a disciplined approach to avoid high interest charges.

Summary of Financial Realities

The most important lesson involves the nature of deferred interest. If you choose a “No Interest If Paid in Full” promotion for 6, 12, 18, or 24 months, you must pay the entire balance before the clock runs out. As of mid-2024, the standard purchase APR for new accounts remains high at 32.99 percent. If a single dollar remains on your balance when the promotional period ends, the lender calculates interest at that 32.99 percent rate starting from the original purchase date. This retroactive charge can add hundreds or even thousands of dollars to the cost of a procedure like CoolSculpting or laser skin resurfacing.

For larger investments over 1,000 dollars, CareCredit offers reduced APR options ranging from 17.90 percent to 20.90 percent depending on the length of the plan. These plans use fixed monthly payments calculated as a specific percentage of your initial purchase. While these rates are lower than the standard 32.99 percent, they still represent a significant cost compared to a traditional personal loan or paying with cash.

Your Practical Action Plan

Before you sign any paperwork or schedule a consultation, follow this prioritized checklist to protect your finances.

- Research typical price ranges for your desired treatment. Use 420 dollars for Botox and 707 to 843 dollars per syringe of filler as your baseline estimates.

- Request three itemized quotes from different providers. Ensure these quotes include every possible cost, such as facility fees, anesthesia, or follow-up appointments.

- Verify the credentials of the provider. Confirm they are board-certified and have specific experience with the non-surgical treatment you want.

- Read the written financing terms provided by the clinic. Do not rely on a verbal explanation of how the interest works.

- Ask the office manager about cash discounts. Many clinics offer a 5 to 10 percent reduction if you pay upfront because it saves them from paying merchant processing fees.

- Compare the total “out the door” costs of each clinic. A lower procedure price might be offset by higher hidden fees.

- Calculate the total interest cost for any financing option. Use the CareCredit payment calculator to see exactly how much you will pay over the life of the loan.

- Set an exact repayment schedule. If you use a 12-month interest-free plan, aim to pay it off in 10 months to create a safety buffer.

Comparing Financing Costs

The following table illustrates the fixed monthly payment percentages for reduced APR plans on purchases over 1,000 dollars. These figures help you understand the monthly commitment required for longer-term financing.

| Plan Length | Applicable APR | Monthly Payment Percentage |

|---|---|---|

| 24 Months | 17.90% | 4.9876% |

| 36 Months | 18.90% | 3.6605% |

| 48 Months | 19.90% | 3.0377% |

| 60 Months | 20.90% | 2.6997% |

When to Choose Each Payment Method

Cash is almost always the best option if you can afford it. It allows you to negotiate for the best price and avoids the risk of debt. If you have the funds sitting in a high-yield savings account, you are essentially getting a discount by not paying interest. You should only use CareCredit if you have a guaranteed source of income to clear the balance within the promotional window. It is a useful tool for spreading out a 2,000 dollar expense over 12 months, provided you never miss a payment. Missing a payment or paying late can trigger a penalty APR as high as 39.99 percent on some accounts.

A personal loan from a credit union or bank might be a better choice for very expensive surgical procedures or extensive non-surgical packages. If you need more than two years to pay off the balance, a bank loan often provides a lower fixed interest rate than the 17.90 to 20.90 percent offered by medical credit cards. Protecting your health means choosing a qualified provider, but protecting your finances means choosing the cheapest way to pay for that expertise.

The most expensive aesthetic treatment is the one that continues to charge you interest long after the results have faded.

Take the time to read the Understanding Promotional Financing guide before you commit. Compare the itemized quotes you received and look closely at the fine print of your credit agreement. By doing the math now, you ensure that your investment in your appearance does not become a long-term financial burden. Check the prices, verify the terms, and only book your appointment when you are certain the numbers work in your favor.

Sources

- CareCredit FAQs — The APR is 32.99% for new accounts (as of 5/30/24). Existing cardholders should see their credit card agreement for applicable terms. The Minimum Interest …

- CareCredit FAQs for Providers — Our No Interest If Paid in Full option allows for 6, 12, 18 or 24 months of promotional financing on qualifying purchases of $200 or more.

- CareCredit – Crafted Aesthetics — **For New Accounts as of 5/30/2024: Purchase APR 32.99%. Penalty APR 39.99%. Min Interest Charge $2. CareCredit Rewards Mastercard: Cash APR …

- Cosmetic & Plastic Surgery Financing Options – CareCredit — Learn about our cosmetic and plastic surgery financing options to get the look you want with convenient monthly payments and promotional financing.

- Understanding Promotional Financing: What It Is & How It Works — For New Accounts as of 5/30/2024: Purchase APR 32.99%. Penalty APR 39.99%. Min Interest Charge $2. CareCredit Rewards Mastercard: Cash APR 32.99% and 4% Fee ($ …

- Financing with CareCredit & Cherry Pay — Exact terms and APR depend on credit score and other factors. For example, a $400 payment plan with Cherry may cost $100/month over 3 months at 0% APR with down …

- Care Credit – Vida Aesthetics And Wellness — No Interest: When you pay off your balance before the promotional period ends. · Standard APR: 26.99% if the balance isn't paid in full by the end of the …

- Payment Plans | LOURE Aesthetics — We now accept CareCredit to pay for your aesthetic or weight loss services with NO TRANSACTION FEE! CareCredit is a health and wellness credit card with …

- Prequalify and Apply for a CareCredit Credit Card – CareCredit — **For New Accounts as of 5/30/2024: Purchase APR 32.99%. Penalty APR 39.99%. Min Interest Charge $2. CareCredit Rewards Mastercard: Cash APR 32.99% and 4% Fee …

- Estimated Monthly Payment Calculator – CareCredit — This calculator estimates your monthly payments based on the amount you'd like to finance with the CareCredit credit card and the promotional financing option …