Many patients wonder whether FSA or HSA funds can pay for non‑surgical aesthetic treatments and how to compare clinic prices before booking. This article explains IRS rules about qualified medical expenses, shows typical U.S. price ranges for Botox, fillers, and CoolSculpting, and gives practical steps to document medical necessity, compare offers, and avoid overpaying at clinics.

How FSA and HSA Work for Aesthetic Treatments

Flexible Spending Accounts (FSA) and Health Savings Accounts (HSA) offer a distinct financial advantage for healthcare costs. You contribute pre-tax dollars to these accounts, reducing your overall taxable income. You then spend that money on qualified medical expenses. The Internal Revenue Service (IRS) governs exactly what counts as a qualified expense. This distinction becomes complicated when applied to aesthetic medicine. The line between medical necessity and cosmetic improvement determines whether you can use these funds without penalty.

IRS Standards for Medical Care vs. Cosmetic Surgery

IRS Publication 502 provides the standard for determining eligibility. It defines medical care as amounts paid for the diagnosis, cure, mitigation, treatment, or prevention of disease. It includes treatments affecting any structure or function of the body. The definition explicitly excludes cosmetic surgery. The IRS defines cosmetic surgery as any procedure directed at improving the patient’s appearance that does not meaningfully promote the proper function of the body or prevent or treat illness.

A procedure must treat a specific medical condition or physical deformity to qualify. The deformity must arise from a congenital abnormality, a personal injury, or a disfiguring disease. If the primary goal is aesthetic enhancement, the expense is personal. You cannot use FSA or HSA funds for personal expenses.

Common Aesthetic Treatments and Eligibility

Many treatments in aesthetic clinics serve dual purposes. The eligibility depends entirely on the diagnosis and the intent of the procedure. You must distinguish between the drug or device and the reason for its use.

Botulinum Toxin Injections

Botox and similar neurotoxins are the most common source of confusion. Using Botox to smooth glabellar lines, crow’s feet, or forehead wrinkles is a cosmetic procedure. It improves appearance but treats no underlying pathology. You cannot use tax-advantaged funds for this. However, the same drug treats chronic migraines, cervical dystonia, and severe axillary hyperhidrosis. These are medical conditions. If a neurologist or dermatologist administers Botox for a diagnosed medical condition, the expense qualifies. The documentation must clearly state the medical diagnosis rather than an aesthetic concern.

Dermal Fillers

Soft tissue fillers generally fall under the cosmetic exclusion. Patients seeking lip augmentation, cheek volume, or jawline definition for aesthetic balance cannot use FSA or HSA funds. For most people, fillers are considered a cosmetic treatment. Exceptions exist for reconstructive purposes. A patient might need fillers to correct a deformity arising from trauma or surgery. Restoring facial volume lost due to HIV-associated lipodystrophy qualifies as medical care. Reconstructing tissue after skin cancer removal also qualifies. The key factor is whether the treatment restores function or normal appearance after a disfiguring event.

Body Contouring and Fat Reduction

CoolSculpting and other non-invasive fat reduction technologies are almost always elective. They target stubborn fat pockets to improve the body’s silhouette. This is not a qualified medical expense. A specific medical diagnosis changes the status. A patient with a diagnosed metabolic disorder causing abnormal fat distribution might qualify if a physician deems the treatment medically necessary. This is rare and requires extensive documentation. Treatments for medical lipodystrophy differ significantly from elective body contouring in the eyes of the IRS.

The Importance of Documentation

You cannot rely on a credit card receipt to prove eligibility. A receipt showing a charge to a dermatology clinic or med spa is insufficient. Plan administrators and the IRS require proof that the service was medical. You need an itemized invoice or “superbill.” This document must list the specific services, the date of service, and the amount paid. It should ideally include the CPT code for the procedure and the ICD-10 diagnosis code.

The ICD-10 code is critical. It tells the plan administrator why the treatment happened. A code for “Age-related physical debility” will likely trigger a denial for a laser treatment. A code for “Rosacea” or “Acne scarring” might support a claim for specific laser therapies if the plan allows it.

You often need a Letter of Medical Necessity (LMN). This is a formal statement from your physician detailing your specific medical condition and explaining why the recommended treatment is necessary to alleviate that condition. It confirms the treatment is not primarily for cosmetic purposes. FSA administrators frequently request this document before releasing funds or reimbursing a claim. Ensure your provider uses a format similar to the following:

[Physician Letterhead] Date: [Current Date] To Plan Administrator: Patient Name: [Your Name] DOB: [Your Date of Birth] Diagnosis: [Specific Medical Condition, e.g., Chronic Migraine] ICD-10 Code: [Relevant Code] I am writing to certify that the following treatment is medically necessary for this patient to treat the condition listed above. This procedure is not for cosmetic purposes. Recommended Treatment: [Specific Procedure, e.g., Botulinum Toxin Injections] Duration of Treatment: [e.g., Every 12 weeks for 1 year] Failure to provide this treatment results in [describe symptoms, e.g., debilitating pain, inability to work]. Sincerely, [Physician Signature] [Physician NPI Number]

Plan Administrators and Payment Logistics

Plan administrators handle transactions differently. Some issue debit cards that work directly at medical offices. These cards rely on Merchant Category Codes (MCC). If a med spa registers as a beauty salon rather than a medical provider, the card terminal will decline the transaction. You must then pay out of pocket and submit a claim for reimbursement. Other plans require manual claim submission for all expenses regardless of the merchant code.

Plan language varies by employer. An employer-sponsored FSA might have stricter exclusions than the general IRS guidance. Some plans exclude all dermatology services unless pre-authorized. You must read the Summary Plan Description. This document outlines exactly what your specific plan covers. Do not assume that because a procedure is IRS-eligible, your specific FSA administrator will approve the transaction without friction.

Financial Risks and Tax Consequences

Misusing these funds carries financial risks. If you use HSA funds for non-qualified cosmetic expenses, the amount becomes taxable income. You must report it on your tax return. You also face a 20% penalty if you are under age 65. No, you generally can’t use an HSA for cosmetic surgery and get the tax benefits. The cost of the penalty often outweighs the potential tax savings. FSA misuse usually results in a denied claim. You must then pay the provider with post-tax dollars. You might lose the FSA funds if you cannot find another eligible expense before the plan year ends. This is the “use it or lose it” rule common to many FSA plans.

Steps for Patients Before Booking

You should take specific actions to protect your finances before scheduling a procedure. Verification prevents surprise bills and tax penalties.

- Verify Plan Rules: Log into your FSA or HSA portal. Read the list of eligible expenses. Look for specific exclusions regarding dermatology or plastic surgery.

- Consult the Provider & Request Codes: Ask the clinic specifically about billing codes. Ask if they provide itemized receipts with ICD-10 and CPT codes. A clinic that only provides a generic register receipt is not suitable for HSA reimbursement. Ask specifically for the brand names of products used.

- Secure Documentation: Request a Letter of Medical Necessity if your condition is in the gray area. Do this before the treatment. The doctor needs to sign it and date it.

- Check Payment Methods: Confirm whether the provider accepts HSA/FSA cards. Ask if their merchant code is medical. Be prepared to pay with a personal card and seek reimbursement later to ensure you have time to gather all required paperwork.

- Maintain a Permanent Audit File: Create a digital or physical folder. Save the Letter of Medical Necessity, the itemized invoice, and the proof of payment. Keep these records for at least seven years for plan audits and tax filings.

The variability between providers and plans is significant. One administrator might approve a claim that another denies. One clinic might offer detailed medical coding while another refuses to alter their standard cosmetic invoice. You must verify the specifics with your plan administrator and the clinic. Detailed records are your only defense in an audit.

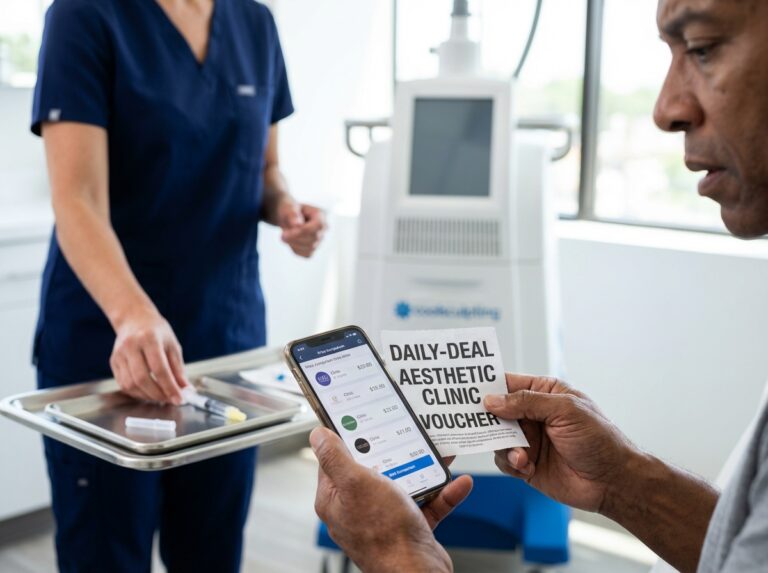

How Clinics Price Aesthetic Services and Typical U.S. Price Ranges

Understanding the financial side of aesthetic treatments requires more than just knowing your tax benefits. You need to know exactly how clinics structure their bills. Prices in 2025 vary significantly based on the provider and the location. A clear understanding of these pricing models helps you avoid overpaying.

Common Clinic Pricing Models

Clinics use specific formulas to calculate costs. You must identify which model a provider uses before booking an appointment.

Per Unit Pricing

Neuromodulators like Botox, Dysport, and Xeomin are liquids measured in units. This is the most transparent pricing method. You pay only for the exact amount used. A standard forehead treatment might require 20 units. If the price is $15 per unit, you pay $300.

Per Area Pricing

Some clinics charge a flat fee for a specific facial zone. This might be the “glabella” or the lines between the eyebrows. This model can be risky for the consumer. You might pay for 20 units but only receive 12. Always ask how many units are included in the flat fee.

Per Syringe Pricing

Dermal fillers are sold by the syringe. Most syringes contain 1.0 cc of product. You generally pay for the full syringe even if you only need 0.8 cc. The clinic cannot save the remainder for another patient due to safety regulations.

Per Cycle Pricing

Body contouring treatments like CoolSculpting use a “cycle” or “application” model. One cycle represents one time the applicator is attached to your body for a set duration. Treating both flanks usually requires two cycles. Treating the full abdomen might require four or more.

Membership and Package Pricing

Many practices offer monthly memberships. You pay a monthly fee to bank money for future treatments or to unlock discounted per-unit rates. Packages bundle multiple sessions of microneedling or laser treatments for a lower total cost than paying per visit.

Factors That Influence the Price Tag

The number on the price tag reflects more than just the cost of the product. Several variables dictate the final quote.

Provider Credentials

Who holds the needle matters. A board-certified plastic surgeon or dermatologist generally charges the highest rates. Their extensive training commands a premium. A nurse practitioner or physician assistant often charges less. Registered nurses usually offer the most competitive rates. You are paying for their anatomical knowledge and ability to manage complications.

Geographic Location

Overhead costs drive pricing. A clinic in downtown Manhattan or Beverly Hills pays significantly higher rent than a practice in a secondary market like Kansas City or San Antonio. These costs are passed to the patient. Expect to pay 20% to 40% more in major metropolitan coastal cities compared to the Midwest or South.

Product Brand

Name recognition affects cost. Botox Cosmetic typically costs more than competitors like Jeuveau or Xeomin. The same applies to fillers. The Juvéderm and Restylane families often carry a higher price point than newer or less marketed hyaluronic acid brands.

Facility Accreditation

Clinics with AAAASF or JCAHO accreditation maintain hospital-grade safety standards. This requires expensive equipment and rigorous protocols. These facilities often charge more to cover these operational standards.

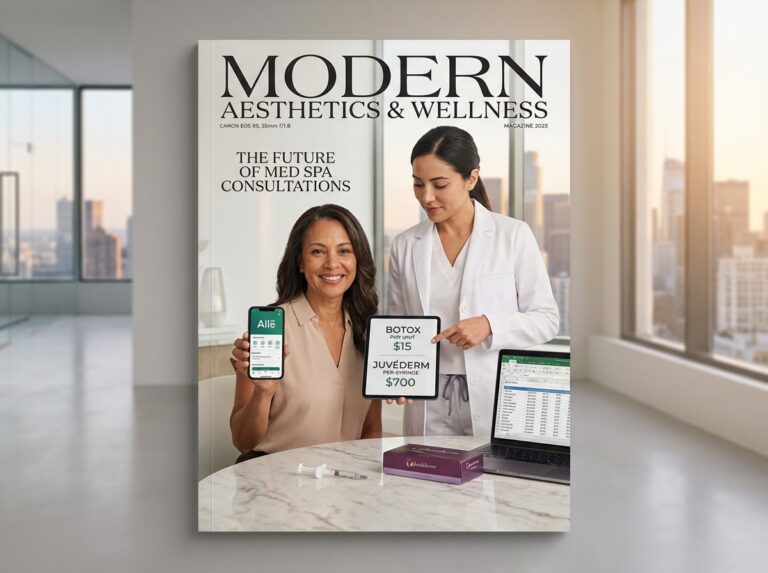

Typical U.S. Price Ranges for 2025

These ranges reflect current market rates. They assume a licensed, reputable provider. Prices significantly lower than these ranges often indicate counterfeit product or inexperienced injectors.

Botox and Neuromodulators

The cost per unit typically lands between $10 and $20.

- Forehead lines: $200 to $400.

- Crow’s feet: $250 to $500.

- Masseter (jaw slimming): $600 to $1,200.

Hyaluronic Acid Fillers

Prices are per syringe. Most patients need more than one syringe for visible results in the midface.

- Lips: $650 to $900 per syringe.

- Cheeks and Midface: $800 to $1,500 per syringe.

- Jawline and Chin: $1,600 to $3,000 (often requires 2 to 4 syringes).

CoolSculpting and Body Contouring

Pricing depends on the number of cycles.

- Per Cycle: $700 to $1,500.

- Small area (Chin): $1,400 to $2,000.

- Large area (Abdomen or Flanks): $2,500 to $4,000.

Skin Rejuvenation

- Microneedling: $150 to $700 per session. Adding PRP (Platelet-Rich Plasma) increases the cost by $300 to $500.

- Laser Resurfacing: $500 to $3,500 depending on depth (ablative vs. non-ablative).

- Chemical Peels: $150 for light peels up to $600 for deep medical-grade peels.

How to Parse a Clinic Estimate

A verbal quote is insufficient. You need a written breakdown. The estimate should list the specific brand name of the product. “Lip filler” is too vague. It should say “Juvéderm Ultra XC” or “Restylane Kysse.”

Check the unit count or volume. Ensure the estimate specifies the number of units for Botox or the number of syringes for filler. If the quote is for a laser treatment, check if it covers the full face or just a specific zone.

To get an accurate comparison, use this phrasing when calling clinics:

“I am price shopping for [Procedure]. Can you tell me the price per unit or per syringe? Does that price include any facility fees, numbing cream, or follow-up appointments? I need the full out-of-pocket estimate.”

Look for hidden fees. Ask if the price includes the consultation fee or if that is separate. Check if post-procedure follow-ups are included. Some clinics charge for the two-week follow-up appointment. Others include it as part of the service.

Checklist for Comparing Quotes

Use this checklist when evaluating different providers.

- Itemized Breakdown: Does the quote list the cost per unit or per syringe separately from the procedure fee?

- Provider Level: Are you being quoted for a surgeon, a nurse practitioner, or a nurse?

- Product Longevity: Ask how long the specific product lasts. A cheaper filler that lasts six months might cost more long-term than a premium filler that lasts two years.

- Payment Options: Confirm if they accept HSA or FSA cards directly. Some clinics treat fillers as purely cosmetic, while others may process them if you have a Letter of Medical Necessity.

- Revision Policy: What happens if the results are uneven? Ask if touch-ups are free or billed at the standard rate.

- Cancellation Fees: Check the penalty for rescheduling. Many clinics charge $50 to $100 for cancellations within 24 hours.

Red Flags and Negotiation Tactics

Be cautious of prices that seem too low. A promotional price of $7 per unit for Botox is a major red flag. This often implies the product is over-diluted with saline or is a “gray market” import not approved by the FDA.

Avoid clinics that refuse to show you the product packaging. You have the right to see the box and the expiration date before they open it.

Negotiation is possible in aesthetics. You just need the right approach.

Ask for Package Deals

Clinics prefer guaranteed revenue. Ask if they offer a discount for buying a package of three microneedling sessions upfront. This can often save you 10% to 20%.

Combine Treatments

Providers save time when you do multiple areas in one visit. Ask if there is a “multi-syringe discount” if you treat your cheeks and lips in the same appointment.

Join Loyalty Programs

Manufacturers have rewards programs like Allē (Allergan) or Aspire (Galderma). These points translate to cash off your treatment. Ensure the clinic participates in these programs and will credit your account.

Request a “Bank” Option

Some clinics allow you to pre-purchase Botox units in bulk during a sale. You might buy 100 units at a discount and use them over the course of a year.

Always get the final agreed price in writing before the procedure begins. This prevents surprise charges at the front desk when your face is still numb.

Frequently Asked Questions

Navigating the rules of Flexible Spending Accounts and Health Savings Accounts often feels like walking a tightrope. You want to maximize your pre-tax dollars without triggering an IRS audit or getting your card suspended. The following questions address the most common confusion points regarding aesthetic medicine and tax-advantaged accounts. These answers assume current regulations as of 2025.

Can I use my FSA or HSA for Botox or fillers?

The short answer is usually no. The IRS draws a hard line between cosmetic procedures and medical treatments. If the primary purpose is to smooth wrinkles, plump lips, or restore facial volume for appearance, the expense is not eligible. This applies even if you feel the treatment improves your mental health or self-esteem.

However, there are medical exceptions where Botox is a covered treatment. If you receive injections for chronic migraines, TMJ (temporomandibular joint dysfunction), or hyperhidrosis (excessive sweating), these are considered medical conditions. In these cases, you can use your funds. The key is the diagnosis. Your provider must document a medical need rather than a cosmetic desire.

Fillers are almost exclusively cosmetic and rarely qualify for medical necessity exceptions. Unless the filler is used for reconstructive surgery following an accident or a congenital deformity, expect to pay out of pocket.

When is a cosmetic procedure actually eligible?

A procedure becomes eligible only when it treats a specific illness, functioning issue, or deformity. The IRS Publication 502 standard states that the treatment must meaningfully promote the proper function of the body or prevent or treat an illness or disease.

Common examples of eligible “crossover” treatments include:

- Blepharoplasty (Eyelid Surgery): Eligible only if drooping skin impairs your vision. It is not eligible if you just want to remove under-eye bags.

- Breast Reduction: Eligible if the weight causes back pain or spinal issues. Breast augmentation is generally ineligible unless it is reconstructive following a mastectomy.

- Laser Treatments: Eligible for treating port-wine stains or severe scarring that restricts movement. Ineligible for general skin resurfacing or anti-aging.

- Acne Treatments: Medical-grade peels or laser sessions prescribed specifically for active acne disease may qualify. Treatments for old acne scars usually do not.

Can my HSA/FSA card be used at a medspa?

Technically, the card might work at the terminal, but that does not mean the expense is legal. Payment terminals use Merchant Category Codes (MCC). If a medspa is coded as a medical provider, the transaction will likely go through. If they are coded as a beauty salon or spa, the card will decline immediately.

If the transaction goes through, do not assume you are safe. Plan administrators frequently audit transactions at medspas because they are high-risk venues for non-qualified spending. If you swipe your card for a facial and cannot prove it was for a medical condition like severe acne, you will have to pay that money back.

What if the clinic charges my HSA card and my claim gets denied?

This happens frequently. You might swipe your card for $600 worth of Botox, and three weeks later, you receive a letter from your HSA/FSA custodian demanding justification. If you cannot provide an LMN or a medical diagnosis, the expense is deemed ineligible.

You generally have two options to fix this:

- Refund the Account: You write a personal check or transfer money back into your HSA/FSA to cover the ineligible amount. This corrects the error with no penalty.

- Reclassify the Expense: If you have other eligible receipts from that year (like contact lenses or pharmacy copays) that you paid for with cash, you can submit those to offset the ineligible charge.

If you do neither, the amount is considered taxable income, and you will likely owe a 20% penalty to the IRS when you file your taxes.

Are skincare products, supplements, or over-the-counter treatments eligible?

General skincare is almost never eligible. Moisturizers, anti-aging serums, and eye creams are considered “general health” items. However, there are specific exceptions:

- Sunscreen: Broad-spectrum sunscreen with SPF 15 or higher is eligible. It is considered a preventative measure against skin cancer.

- Acne Medication: Over-the-counter acne treatments containing active ingredients like salicylic acid or benzoyl peroxide are eligible.

- Supplements: These are rarely eligible unless prescribed by a doctor to treat a specific deficiency (like Vitamin D for a diagnosed deficiency). “Hair, Skin, and Nails” vitamins are not eligible.

Final Conclusions and Practical Next Steps

We have covered the specific pricing models, the tax rules, and the common questions regarding using your health accounts for aesthetic treatments. You now have the background information necessary to distinguish between a standard beauty treatment and a medically necessary procedure. The final step is turning that information into a concrete plan. You need a strategy to navigate the clinic system, secure your tax benefits, and protect your wallet from inflated costs.

The Golden Rule of Eligibility

The distinction between eligible and ineligible expenses is rigid. The IRS does not care if a treatment makes you feel better about yourself. They care about the physiological function of the body. Purely cosmetic procedures designed to improve appearance are almost never eligible for FSA or HSA reimbursement. This includes standard Botox for wrinkles, lip fillers for volume, or laser treatments for general skin rejuvenation.

Funds from these accounts can only be used when the treatment addresses a specific medical diagnosis or physical deformity. This might include Botox for chronic migraines, laser therapy for severe acne scarring that causes pain or infection, or reconstructive work following trauma. If you cannot prove a medical need with documentation from a physician, you should assume the expense is personal. Using tax-advantaged funds for ineligible cosmetic procedures can lead to tax penalties and the requirement to pay back the funds.

Consumer Protections and Safety

Price is a major factor, but it cannot be the only metric. The aesthetic market is flooded with unqualified providers offering discount services. You must insist on a written estimate before any needle touches your skin. This estimate should match the final bill. If a clinic refuses to give you a firm price in writing beforehand, walk away.

Verify the credentials of the person performing the procedure. A board-certified dermatologist or plastic surgeon commands a higher price for a reason. They have the training to handle complications. “Discount” fillers found online or at unverified spas can be counterfeit or diluted. Learn what counts as a qualified medical expense and ensure you are paying for legitimate medical care, not a dangerous shortcut.

Your health and your financial security are linked. By following the steps outlined in this guide—verifying plan coverage, securing medical necessity letters, and maintaining audit files—you ensure that you are using your hard-earned money wisely. You avoid the trap of paying for ineligible services that could trigger tax penalties. You also protect yourself from clinics that obscure their pricing. Treat every aesthetic procedure with the same rigorous scrutiny you would apply to a major surgery or a significant financial investment.

Sources

- Can You Use HSA & FSA For Fillers? – Injectco — For most people, fillers are considered a cosmetic treatment, which means they're not usually covered by HSA or FSA accounts. If you're thinking …

- Can You Use Your HSA for Cosmetic Surgery Costs? – GoodRx — No, you generally can't use an HSA for cosmetic surgery and get the tax benefits. The IRS defines cosmetic surgeries as procedures that improve appearance.

- Is My Plastic Surgery HSA-Eligible? – Duly Health and Care — Learn what counts as a qualified medical expense under your HSA, from reconstructive surgery to BOTOX® and acne care. Avoid surprise fees and stay informed.

- Are Cosmetic Procedures FSA Eligible? – FSA Store — Cosmetic procedures (eg facelift, Botox, hair transplants, liposuction, teeth whitening) are usually ineligible, unless the procedure is necessary to improve a …

- HSA, HRA, & FSA Eligible Items & Expenses – Cigna Healthcare — Cosmetic procedures – Medical expenses for cosmetic procedures are reimbursable only if the procedure is necessary to improve a deformity arising from, or …

- Make the Most of Your 2025 Health Benefits – Dallas Associated … — Your ability to apply FSA or HSA funds toward dermatology services depends entirely on the details of your individual insurance plan. Each …

- FSA HSA Eligibility List | American Fidelity — Cosmetic procedures are not eligible for reimbursement. For example, teeth whitening for cosmetic purposes is not eligible. Eligible if purchasing to repair …

Legal Disclaimers & Brand Notices

The content provided in this article is for informational purposes only and does not constitute medical advice, diagnosis, or treatment. Always seek the advice of a physician or other qualified health provider with any questions you may have regarding a medical condition or specific aesthetic procedure. Reliance on any information provided in this article is solely at your own risk.

All product names, logos, and brands are property of their respective owners. All company, product, and service names used in this article are for identification purposes only. Use of these names, logos, and brands does not imply endorsement. This article references the following registered trademarks:

- Botox® and Juvéderm® are registered trademarks of Allergan Aesthetics (an AbbVie company).

- Dysport® and Restylane® are registered trademarks of Galderma.

- CoolSculpting® is a registered trademark of ZELTIQ Aesthetics, Inc.